UPDATED: Brad Faxon and Investors Facing Fraud Claim in Lawsuit by Metacomet Golf Club Members

GoLocalProv Business Team

UPDATED: Brad Faxon and Investors Facing Fraud Claim in Lawsuit by Metacomet Golf Club Members

.png)

The suit was filed in Rhode Island Superior Court on Monday on behalf of Metacomet members Joseph J. Rodger, III; Kekin A. Shah; William G. Cioffi; Dean E. Martins; Mark Welch; Louis Freselone; Scott Desilets; and Jason Kalin.

Faxon and his investment group named METACOMET PROPERTY COMPANY, LLC (MPC), and doing business as Metacomet Golf Club purchased the club for a reported $2.2 million in early 2019.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTFaxon and investors made numerous promises when acquiring the Donald Ross-designed course.

But, a spokesman for Faxon and the other investors told GoLocal that the lawsuit is without merit. “Today, we were made aware of a frivolous legal action by several members of Metacomet Country Club. We believe the allegations are wholly without merit and we will defend against it vigorously," said Dante Bellini, spokesman for MPC.

Fraud Claim

In the lawsuit's fraud claim, the Metacomet members assert, “During the Meeting, and as a result of the November 27th Correspondence, MPC, by and through its Principals, made certain specific statements and/or representations, as well as gave certain assurances to the Members, as detailed hereinabove, with regard to the operation of the Club and the golf course for the 2020 golf season.”

Further, the suit claims, “The Members, and each of them, reasonably relied upon MPC’s intentionally misleading and/or fraudulent statements to their respective detriment in performing pursuant to their contract with MPC.”

The lawsuit claims that “inherent in every contractual relationship is the parties' obligation and duty of good faith and fair dealing with each other. MPC breached its duty of good faith and fair dealing with the Members, and each of them.”

The club members are seeking a temporary restraining order aganist Faxon's MPC.

Documents previously secured by GoLocalProv.com unveil that Faxon and his team of high profile investors including a partner of Governor Gina Raimondo in Point Judith Capital promised to invest millions into the Donald Ross-designed Metacomet Golf Course.

Specifically, the investors assured the club members when purchasing the club in 2019, that the PGA’s Faxon -- a Rhode Island icon -- was dedicated to the “unique love for Metacomet’s fabulous history.”

Further, the investment team promised to put millions into improving the facilities and not to develop the property."We would not expect to do any major alterations to the course related to Real Estate Development in any way for 18-24 months,” said Faxon and his team.

Deal in Focus

The deal between Faxon and his team with the club was just a year ago. Now, Faxon and his team are flipping the property at a massive profit to Marshall Development. The course is slated for demolition and to be replaced with a mixed-use residential and retail development.

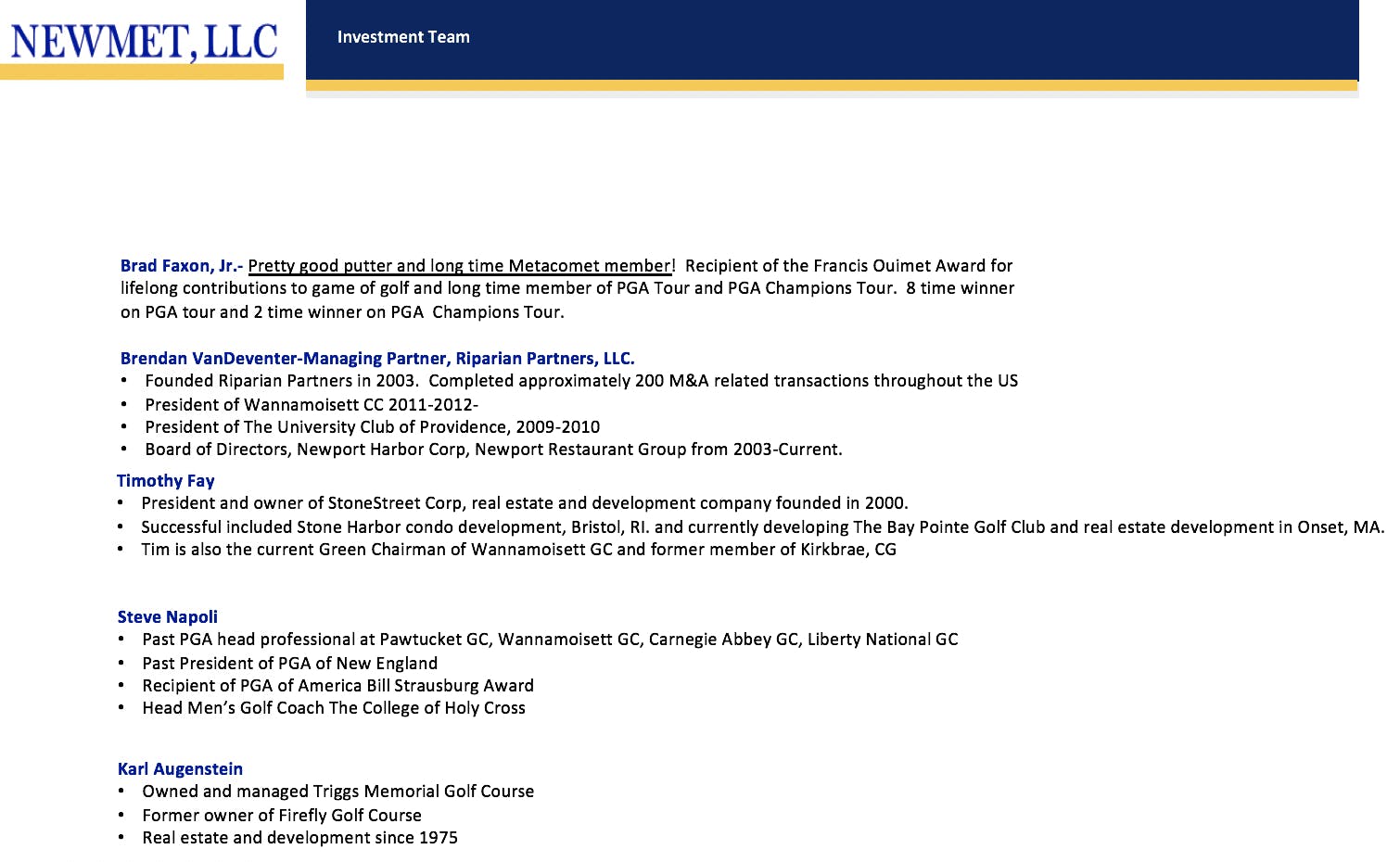

The Faxon investment team includes Brendan VanDeventer, who was one of the original partners with Raimondo in the controversial venture firm co-founded by Raimondo, which has changed its name from Point Judith Capital to PJC and moved from Providence to Boston, MA.

Dante Bellini, a spokesman for the Faxon-led investment group told GoLocal in a statement, "It was not their intention to 'flip the club' as was communicated to you; but you well know business opportunities happen all the time and in this case that came in the form of being approached by Marshall. They did not solicit a proposal. And, accordingly, after careful reflection, made the same prudent business decision any smart business owner or investor would have made."

In a letter dated January 11, 2019 — just a little over a year ago — sent to the chair of the Metacomet board to close the deal, Faxon and partners wrote, “Throughout this evaluation process, our team has tried to convey to you our long-term vision for the future of Metacomet. This vision starts with the all-in commitment and enthusiasm of Rhode Island’s world-renowned ambassador to the game of golf, Brad Faxon.“

“Brad’s unique love for Metacomet’s fabulous history is based on personal experience from great memories from his youth, many relationships with current and past members, and the golf course itself. These experiences coupled with his unquestioned expertise in golf course design, style, and playability will have long-lasting benefits to Metacomet and its membership,” continued the letter.

Faxon and his investors also cited their commitment to the legacy of the course, “All of us, and certainly Brad, have an ongoing vision toward keeping this course as a great 18-hole Donald Ross Championship Golf Course. Any potential minor alterations to the course design will be done under the purview of Brad.”

One club member, who requested anonymity and GoLocal has confirmed was a member at the time that Faxon and his co-investors purchased the club, said, "This was a total bait and switch, and this group is going against everything they told the membership. We selected this group over another competitive bid because of their proposal."

Bellini said in defense of Faxon, "With regard to the assault on Brad’s Faxon character by anonymous club members and Donald Ross 'experts' - they are uninformed and disingenuous. It is literally a shame that they completely disregard the reality of who Brad Faxon is, his character and what he has accomplished over the past 40 years in golf, golf course architecture, education, and public service."

"The impact Brad has had through his philanthropy in this state alone is monumental. He has helped raise nearly $30 million dollars for charities, civic organizations and special events. He is generous with his time, talent and money," added Bellini.

"Moreover, Brad is honest and ethical. He entered this deal with pure intentions and 100% genuine commitment. For all the reasons already discussed, Metacomet was not a sustainable entity as a private club. There is no apology required for not being able to salvage it," said Bellini.

Promises Made

According to 10-pages of documents, Faxon and his fellow investors promised to invest millions in the club. According to multiple sources, the Faxon ownership group spent only a couple of hundreds of thousand dollars -- more than a million less than what was promised.

In the proposal, Faxon and his team promised:

Target capital raise will be approximately $5 million. As part of the $5 million we may keep $1 million +/- of the existing Greenwood Credit Union term debt, but will prefer to pay off the existing Line-of-Credit (“LOC”).

In addition to the assumption of both MET’s existing known liabilities and closing costs (approximately $2.6 to $2.8 million) NEWMET, LLC. ("NEWMET”) will incur additional expenses for environmental review, engineering review of Clubhouse, legal and accounting as well as a limited amount of the Sellers closing transactional and interim operating expenses. It is imperative that the Buyers be informed of any potential non-balance sheet liabilities, such as environmental, OSHA, State Taxes, Workers Comp, or EEOC, etc. The total Transaction, including both MET and NEWMET liabilities and closing costs is estimated to be approximately $3 million. We also expect that the NEWMET will generate some nominal losses for the first part of 2019, as expenses for both Clubhouse Management and additional staff for the Greens crew will have to be provided asap."

When the Faxon team purchase the club, Metacomet was in serious financial trouble. Both Club members and the Faxon team identify a series of financial issues that may have forced the club to close without an infusion of capital.

According to 10-pages of documents, Faxon and his fellow investors promised to invest millions in the club. According to multiple sources, the Faxon ownership group spent only a couple of hundreds of thousand dollars -- more than a million less than what was promised.

In the proposal, Faxon and his team promised:

Target capital raise will be approximately $5 million. As part of the $5 million we may keep $1 million +/- of the existing Greenwood Credit Union term debt, but will prefer to pay off the existing Line-of-Credit (“LOC”).

In addition to the assumption of both MET’s existing known liabilities and closing costs (approximately $2.6 to $2.8 million) NEWMET, LLC. ("NEWMET”) will incur additional expenses for environmental review, engineering review of Clubhouse, legal and accounting as well as a limited amount of the Sellers closing transactional and interim operating expenses. It is imperative that the Buyers be informed of any potential non-balance sheet liabilities, such as environmental, OSHA, State Taxes, Workers Comp, or EEOC, etc. The total Transaction, including both MET and NEWMET liabilities and closing costs is estimated to be approximately $3 million. We also expect that the NEWMET will generate some nominal losses for the first part of 2019, as expenses for both Clubhouse Management and additional staff for the Greens crew will have to be provided asap."

When the Faxon team purchase the club, Metacomet was in serious financial trouble. Both Club members and the Faxon team identify a series of financial issues that may have forced the club to close without an infusion of capital.

This story was first published 3/9/20 1:10 PM