RI’s State Pension & Unfunded OPEB Liability Grows - Tops $4B, But That's Not the Biggest Threat

GoLocalProv News Team

RI’s State Pension & Unfunded OPEB Liability Grows - Tops $4B, But That's Not the Biggest Threat

This number only includes the state’s obligations to two funds for the Rhode Island judiciary, the State Police fund, and state employees. It does not include all the members in the state's retirement funds -- the largest group being teachers.

After more than 15 emails and texts with the General Treasurers office -- they could not answer the bigger question. How much is the total amount needed to fully fund the pension obligations of those in the state system and unfunded liability for the cost of the same group for OPEB?

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST“As of June 30, 2018, the State had approximately $3.38 billion of unfunded actuarial accrued liability (UAAL) in connection with its four pension programs. The most recent actuarial study completed as of June 30, 2017 estimates the State’s OPEB unfunded liability in FY 2018 at approximately $616 million,” state the report -- State of Rhode Island and Providence Plantations Public Finance Management Board Debt Affordability Study -- issued by General Treasurer Seth Magaziner’s office.

But what Magaziners report doesn't identify, Pew Reseach in a separate story does flag.

Pew Research Report Raises Red Flag

A study by Pew Research finds that Rhode Island’s unfunded pension liability is still one of the highest in America.

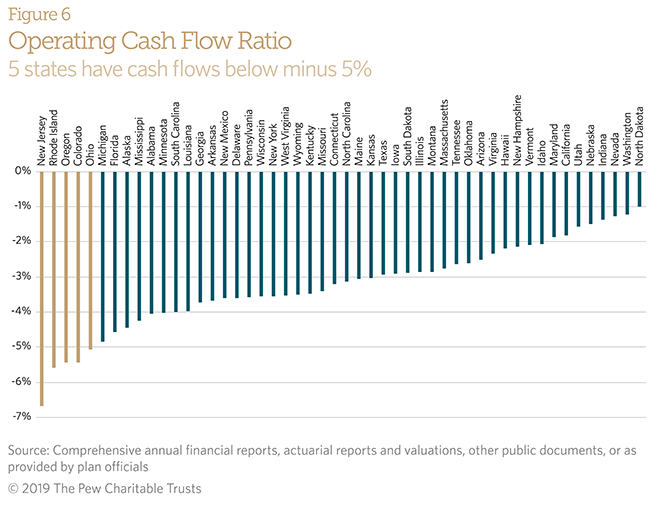

More concerning for Rhode Island may be a red flag Pew Research identified relating to the overall pension fund’s cash flow.

“Operating cash flow measures the difference between cash coming in to state pension plans—primarily through employer and employee contributions—and cash flowing out in the form of benefit payments. Dividing that difference by the value of plan assets provides a benchmark for the rate of return required to keep plan assets from declining. State pension funds typically exhibit negative operating cash flow, which on average has moved from approximately minus 1.9 percent in 2000 to minus 3.2 percent in 2017. That means that state pension plans are now much more dependent on investment performance to keep assets from declining than they were at the turn of the century and therefore increasingly more vulnerable to market volatility,” writes Pew.

Pew reported Rhode Island has the second-worst operating cash flow.

In addition, Pew warns, “Even after nine years of economic recovery, most state pension plans are not equipped to face the next downturn. Policymakers have not taken advantage of strong investment markets to make progress on closing the pension funding gap, which remains at historically high levels as a share of GDP.”

Rhode Island’s unfunded pension obligation is 46.3%. If the state's fund was a municipal fund, the State would deem it to be of “critical” status according to state designations for cities and towns. The State's unfunded liability is nearly the same as it was before pension reform spearheaded by then-General Treasurer Gina Raimondo was implemented in 2011 and 2012.

Magaziner’s report says that, “Comparing pension and OPEB liabilities across states can be challenging, as the pension liabilities and annual costs that states report can vary considerably based on the assumptions and policies that states use to govern their pension systems.”

“This is the first time that Rhode Island has integrated OPEB liabilities into debt affordability targets. While this has not been done in past affordability studies, the PFMB believes that OPEB liabilities are significant enough that they must be considered together with traditional debt and pension liabilities. The credit rating agencies have recently begun to adopt methodologies that combine debt, pension and OPEB liabilities into the same affordability measurements, and it is expected that these comprehensive liability metrics will only become more common over time,” said the report.