Walz, As Chairman of Minnesota Pension System, Agreed To Be Kept In The Dark - Siedle

Ted Siedle, Guest MINDSETTER™

Walz, As Chairman of Minnesota Pension System, Agreed To Be Kept In The Dark - Siedle

The old adage is that a picture is worth a thousand words. In that spirit, see the two pictures below— screenshots from the Minnesota State Board of Investment 2023 Annual Report.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

In response to the question, “Was Walz, as Governor (with absolutely no investment experience—reportedly never having owned a stock or bond) really in charge of the $135 billion state pension system?” Perhaps someone else—maybe a designee or appointee— was really responsible. Maybe the “Chairman” of a massive investment fund established to provide retirement security for hundreds of thousands isn’t, somehow, really in charge?

Here’s what investors, aka pension stakeholders—taxpayers and pension participants—were led to believe:

It sure sounds like reputable fiduciaries were overseeing the retirement savings of government workers. If this were a publicly traded company, the SEC would say investors could justifiably rely upon their oversight.

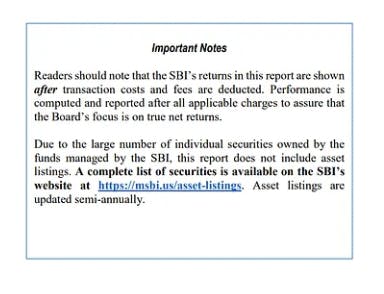

Did Governor Walz know the state pension system was paying billions in fees to Wall Street—fees that were not fully disclosed to the public? Here’s the exceptional (as in unusual, bizarre) disclosure prominent in the Annual Report:

Sounds like Walz and the Board agreed to be kept in the dark— as opposed to fulfilling their legal fiduciary duty to monitor investment fees paid to Wall Street—supposedly… ”to assure that the Board’s focus is on true net returns.”

Evidently, no one thought the Wall Street fee secrecy scheme might be contrary to prudent investment practices, or harmful to the plan and its participants.