CVS Paying 2nd Highest Overall Tax Rate in U.S., Says New Report

GoLocalProv Business Team

CVS Paying 2nd Highest Overall Tax Rate in U.S., Says New Report

WalletHub analyzed annual reports for the S&P 100 — the largest and most established companies on the stock market — in order to determine the federal, state and international tax rates they paid in 2018.

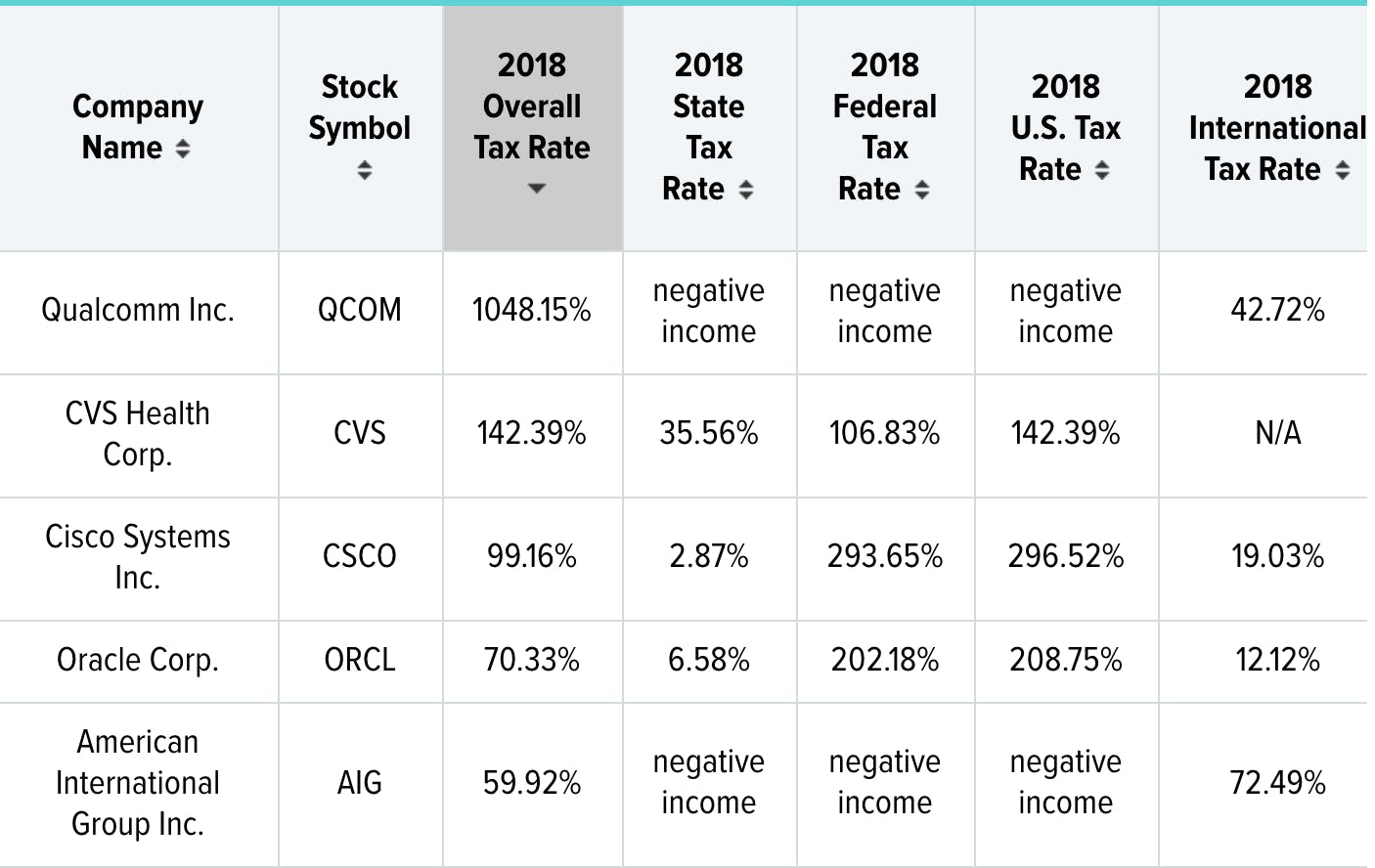

CVS ranked only behind Qualcomm. CVS's rate is over 143 percent, according to the study.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST“One of the largest changes in the plan was that the federal corporate income tax rate was permanently lowered from 35 percent to 21 percent. Republicans championed the tax plan as beneficial to business and consumers and Democrats claimed it would only increase the wealth of the already wealthy. That debate becomes even more relevant as the 2020 presidential election approaches, as the winner will have the power to sign future tax code adjustments into law.

- The overall tax rate that the S&P 100 companies pay, around 21 percent, is more than 15 percentage points lower than they paid in 2017.

- S&P 100 companies pay roughly 7 percent higher rates on U.S. taxes than U.S. taxes international taxes.

- Tech companies, including Facebook Inc., Apple Inc. and Cisco Systems Inc., are still paying more than 15 percent lower rates abroad, continuing the trend from 2013, 2014, 2015, 2016 and 2017.

- Five S&P 100 companies are actually paying a negative overall tax rate and are therefore due a discrete net tax benefit: PepsiCo Inc., AbbVie Inc., Berkshire Hathaway Inc., NVIDIA Corporation and FedEx Corp.

- Among the remaining companies that owe taxes, Netflix Inc., Exelon Corp., General Motors Co., Pfizer Inc. and Adobe Inc. pay the lowest rates.

The average S&P 100 company pays a 35 percent lower tax rate than the top 1 percent of consumers.