Lardaro Report: RI's Economy Regains Momentum in October

Len Lardaro, URI Professor of Economics

Lardaro Report: RI's Economy Regains Momentum in October

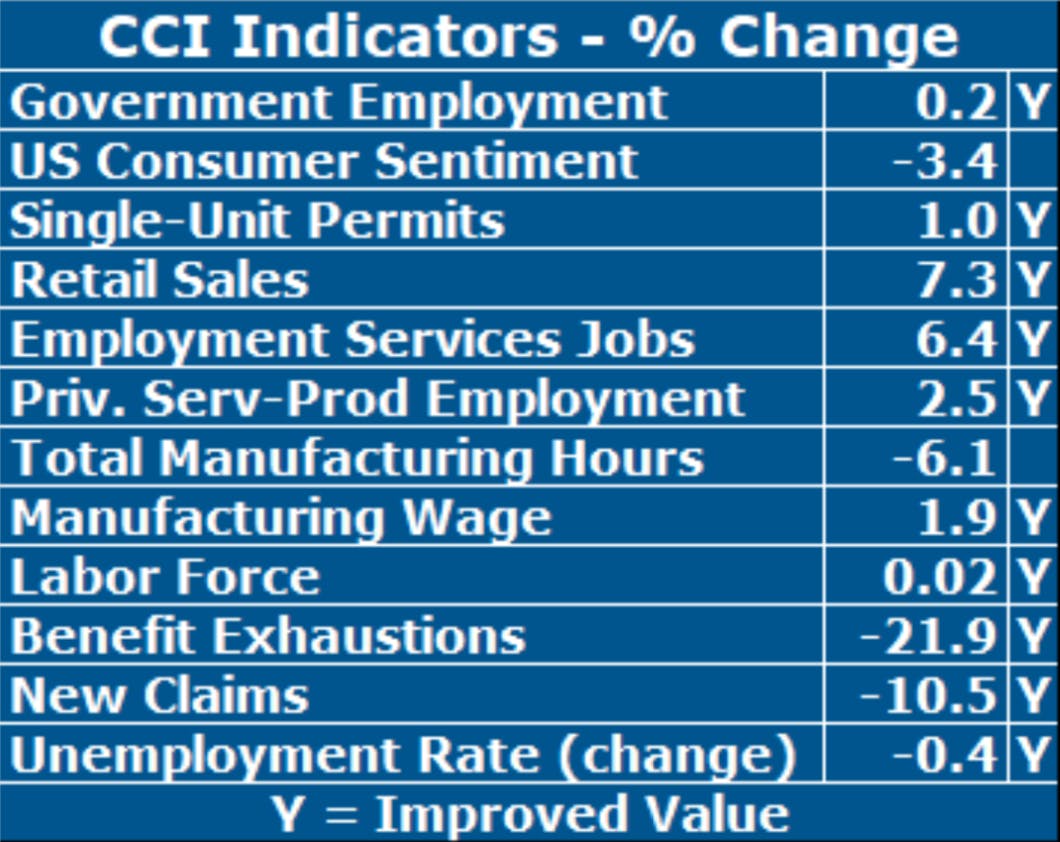

As I have noted in prior months, it is necessary to look “under the hood” at individual indicators and their underlying trends in order to arrive at a meaningful interpretation of Rhode Island’s economic performance. After all, some 83 values are better than others. This month, that worry can be cast aside. October’s CCI was a “solid” 83. The question moving forward, for which I have no answer, is whether a frequent pattern in Rhode Island’s historical behavior will revisit us: The first month of a quarter shows a strong increase which is then followed by weakening performance for the remaining months of that quarter. I don’t believe this is a seasonal adjustment issue, so something else is apparently at work. We can also rule out a similar pattern for the national or Massachusetts economies. We’ll just have to wait and see how the remainder of 2019 plays out. At least there is substantial momentum for both the US and Massachusetts economies, although it appears to be weakening somewhat.

Two factors in Rhode Island’s performance that merit particular attention are related to resident employment and our Labor Force. While Rhode Island’s Unemployment Rate has been falling for some time now, recently bottoming at 3.5 percent, behind this misleading trend lies the fact that our Labor Force has also been declining on a longer-term basis, both overall and relative to our resident population (i.e., our labor force participation rate has been declining). This, of course, has made it easier to dramatically lower our Unemployment Rate. Accompanying this, resident employment (the number of employed RI residents) has remained well below its 2006 value, and until recently, falling overall and relative to our resident population (the employment rate).

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

In October, ten of the twelve CCI indicators improved, although some annual weakness remains. The greatest area of concern continues to be manufacturing, where Total Manufacturing Hours, a proxy for manufacturing output, fell for the thirteenth consecutive month (6.1%), although the Manufacturing Wage rose. US Consumer Sentiment failed to improve again, while Single-Unit Permits, which reflect new home construction, rose slightly (+1.0%) based on an easy comp. Our Labor Force was largely flat (+0.02%) on a yearly basis but has been doing better monthly. Long-term unemployment, as reflected by Benefit Exhaustions, improved (fell) at a double-digit rate (-21.9%), but has yet to reestablish a downtrend. New Claims for Unemployment Insurance, the most timely measure of layoffs, fell (improved) in October, the fifth time in the last six months.

Retail Sales, continues to be our “star” indicator. For October, it improved by 7.3 percent following a double-digit increase in September. Employment Service Jobs, a leading indicator that includes temps, rose impressively in October (+6.4%), its seventh consecutive increase. Private Service-Producing Employment rose for a seventh consecutive month (+2.5%). Finally, Government Employment increased again in October for the thirteenth time in the last fourteen months, remaining well over 61,000.