Lardaro Report: "Virtually Nothing to Cheer About" in October

Len Lardaro, URI Economist

Lardaro Report: "Virtually Nothing to Cheer About" in October

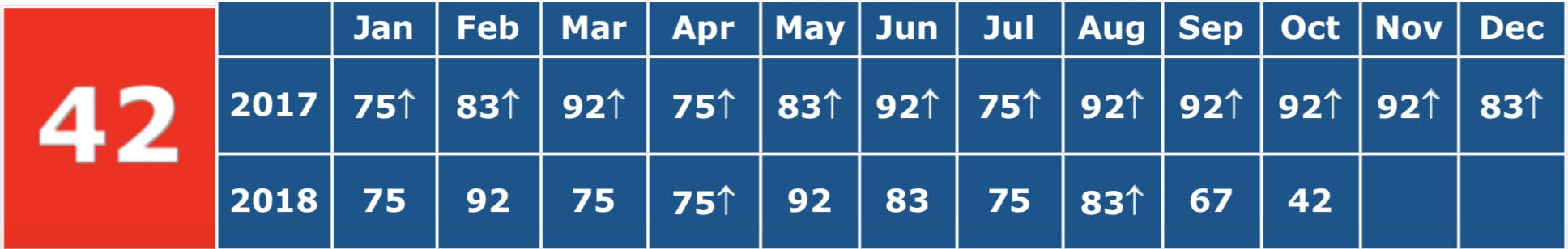

The good news, and there is a little, is that the CCI trend since the recent May high has not been straight down. The October CCI results pertain to a single month yet continue a disturbing trend. Further confirmation of a true downtrend is still required before we can interpolate longer-term trends. Perhaps the most potentially optimistic note is that historically, labor market values for October through December are those most likely to be altered with rebenchmarking. I’m not so sure we will see that, given that the national economy and those of Europe and Asia are also slowing, and that Rhode Island has richly earned its status as FILO. So, the question continues: Are we in the FI stage?

No matter how it is viewed, one thing remains clear: Rhode Island’s rate of growth is continuing to slow. The string of weakening CCI values indicates that the foundation of this recovery is standing on fewer “legs,” as our negatives continue to gain relative to our positives.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

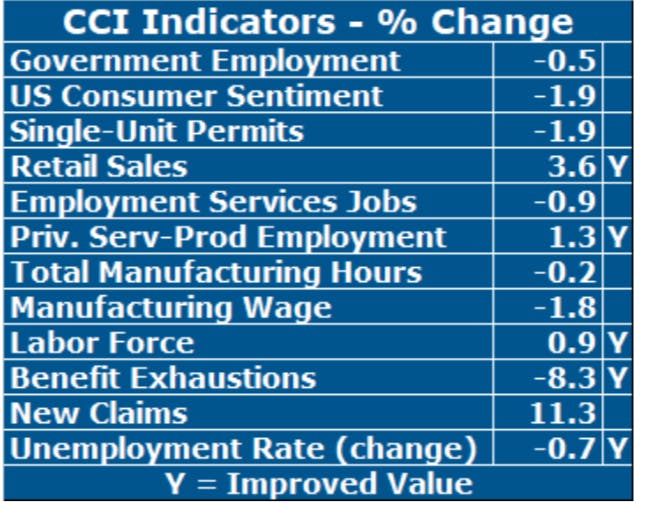

New Claims, the timeliest measure of layoffs, rose by double digits in October (+11.3%), its third increase in the last five months. Layoffs appear to be in the early stages of what might prove to be an uptrend, a very unwelcome result should it prove to be true. Rhode Island’s goods-producing sector’s performance was its worst in a while. Total Manufacturing Hours, a proxy for manufacturing output, what had been an important part of Rhode Island’s recent strength, fell this month (-0.2%). This was its first decline since March, the result of a shorter workweek. The Manufacturing Wage fell again in October (-1.8%). Single- Unit Permits, which reflect new home construction, continued its recent string of declines (-1.9%), its fifth decline in the last five months. Employment Service Jobs, a leading labor market indicator that includes temporary employment, failed to improve for only the second time in four months (-0.9%) after rising both of the prior two months. US Consumer Sentiment fell in October (-1.9), challenging its recent uptrend. In light of recent stock market weakness and a strengthening US Dollar, much of the weakness observed with these indicators in October is likely to persist as we move to the end of 2018.

Both of the “left behind” indicators failed to improve in October, as their uptrends that began in January are in question. The labor force participation rate, the percentage of our resident population in the labor force, fell in October (to 64.8 percent). The employment rate, the percentage of the resident population that is employed, has plateaued around 62 percent since May. Sadly, both remain well below their prior cyclical highs (see table).

Retail Sales grew again (+3.6%), Government Employment fell from its level a year ago for a second consecutive month (-0.5%), Private Service-Producing Employment growth slid, while still remaining above one percent (+1.3%), and Benefit Exhaustions, the most timely measure of longer-term unemployment, resumed its downtrend in October. The Unemployment Rate continued its monthly declines, but so too did our Labor Force.

50 Ways to Give in RI This Holiday Season - 2022

Ronald McDonald House of Providence

Providence

There is nothing more important to parents and families than being as close to their kids as possible while they are in the hospital. Help more families be close to their kids, donate HERE.

Every year, over 300 families stay at the House while an additional 1,900 enjoy the Family Room. Both rooms are designed to keep families close during hospitalizations.

The Ronald McDonald House makes a difference by:

- providing a safe and caring environment to families with children at hospitals

Books are Wings

Pawtucket

Kids from low-income families, ethnic minority groups, and English language learners are at the highest risk for lacking the fundamental tools that provide the basic building blocks for reading.

Books are Wings is trying to change that by providing FREE books. Help them out by making a donation HERE.

At Books Are Wings Book Parties, kids read stories, discuss literature, spell their names and get FREE books to help their reading skills at home.

Books are Wings makes a difference by:

- providing children with FREE books needed in their homes to continue ongoing literacy efforts

Children's Friend

Providence

You can never donate enough to benefit the well-being of kids.

Children's Friend is one of the leaders in attempting to improve the lives of children. Donate to them HERE.

How important are they? With centers in Providence, Pawtucket and Central Falls, Children’s Friend serves over 30,000 of Rhode Island's most vulnerable children and their families each year.

Children's Friend makes a difference by:

- providing flexible, effective, and culturally-relevant services

- advocating for programs and policies that support and strengthen children and their families

United Way of RI

Providence

The mission of the nonprofit is "uniting our community and resources to build equity and opportunities."

UWRI is in the middle of its LIVE UNITED 2025 strategic plan that is guiding the nonprofit through 2025, just in time for its centennial celebration.

Here is what UWRI is doing right now in each of its four focus areas:

LIFT UNITED: Building economic security.

ACHIEVE UNITED: Advancing childhood learning.

INVEST UNITED: Expanding philanthropy.

ADVOCATE UNITED: Driving policy and participation.

Sojourner House

Providence

Domestic violence is an issue around the country and often times it takes time for victims to feel safe again.

Sojourner House, Inc. is a domestic violence agency that assists victims of relationship violence by providing shelter, advocacy, and violence prevention education. Make a donation HERE.

Donate to their safe house wish list with items like toaster ovens, small tables, pillows, fitted sheets, and pots and pans for their residents.

Sojourner House makes a difference by:

- operating a 24-hour Help Line

- safe house shelter and transitional housing program

- free rapid HIV testing

- support and empowerment group and advocacy services

Capital Good Fund

Providence

The Capital Good Fund works to create pathways out of poverty for Rhode Islanders by providing affordable loans that take the place of payday loans, buy-here-pay-here car financing, and rent-to-own pricing. Donate HERE.

How important are they? To date, they have provided 3,254 loans totaling $6,291,496 have been disbursed to low-income Americans.

The Capital Good Fund makes a difference by:

- offering small loans and personalized Financial + Health Coaching to families in Rhode Island

Fierce for Shannon Foundation

The Fierce For Shannon Foundation provides scholarships to high school students, but does so in a way that’s very different from most scholarship-granting organizations.

"We don’t use an application process, it’s done through relationships. The way Shannon built relationships. We find individuals who are nominated by teachers, counselors and staff. We look for those 'bubble' students," says the Foundation. "The ones with unrealized potential. Young people who could use a boost of confidence to help them succeed."

Shannon Heil's life was taken at age 18 in a car accident -- and now her father Brian works to encourage others to "pay it forward" in his daughter's memory.

The effort is a movement and provides scholarships to other.

The Confetti Foundation

Newport

For kids, being in hospitals for any length of time is difficult -- and being there for an extended period of time and missing birthday parties is one of toughest parts.

The Confetti Foundation brings the birthday parties to kids in the hospital. Make a donation HERE.

How important is it? It was started in hopes that families would, for 30 minutes of their child's sickness, just stop and celebrate. With your help -- you can make a difference.

The Confetti Foundation makes a difference by:

- donating party supplies to hospitalized kids

- throwing birthday parties for hospitalized kids

The Matty Fund

Warwick

Living with Epilepsy can be hard on kids and families.

The Matty Fund helps those who are living with the disease have a better life. Donate HERE.

The Matty Fund makes a difference by:

- providing resources and raising awareness

- promoting patient safety

- working to improve the quality of life for children and families

Gaits of Harmony Therapeutic Riding

Saunderstown

There a number of great organizations using horses to help people overcome their lives challenges, and Gaits of Harmony is one of those.

Gaits of Harmony provides people of all ages with chances to educate, enrich and empower themselves in order to overcome challenges of their daily lives through interaction with horses.

It serves thirty clients and involves members of the community all helping clients overcome their own individual challenges.

Gaits of Harmony was named one of the top nonprofits of 2016 by greatnonprofits.org.

Gaits of Harmony Therapeutic Riding makes a difference by:

- therapeutic riding - riding lessons adapted to the ability of the rider in individual or group lessons

- Hippotherapy - a form of physical, occupational or speech therapy in which a therapist uses the characteristic movements of a horse to provide carefully graded motor and sensory input. Offered as private lessons

- interactive vaulting - fosters teamwork, teaches respect for the horse, fosters independence, builds confidence and encourages social interaction. Lesson is both mounted and un-mounted. Offered only as group lessons

Plan International USA, Inc.

Warwick

If you're concerned about children beyond this country's borders, improving the lives of kids and families all around the world is something you can do this holiday season.

Plan International has been working to break the cycle of child poverty for more than 75 years and in over 50 countries. The programs help millions of kids and their families escape poverty over the world.

Plan International was named one of the top nonprofits of 2016 by greatnonprofits.org.

Plan International makes a difference by:

- strengthening health care systems

- advocating for better protection

- working to break the cycle of child poverty

New Urban Arts

Providence

What could be better than supporting an organization that helps inner-city kids develop their creativity? New Urban Arts does just that.

How important is this program? According to New Urban Arts, 500 high school students, 25 emerging artists and over 3,000 visitors benefit through youth programs, professional development workshops, artist residencies, public performances, and exhibitions.

New Urban Arts make a difference by helping youth:

- develop positive relationships with non-parental adult mentors and peers

- acquire standards-based skills & knowledge in the arts

- begin to develop their unique artistic voice

- graduate high school on a path towards post-secondary success

Sweet Binks Rescue

Foster

Sweet Binks Rescue was formally Sweet Binks Rabbit Rescue, they have since expanded to focus on wildlife rehabilitation.

Sweet Binks has rescued and placed about 3500 domesticated rabbits from local shelters, cruelty cases, and strays. Make a donation HERE.

The facility has a 1800 sq. ft. shelter to provide sanctuary to the animals until they are placed.

Sweet Binks Rescue makes a difference by:

- rehabilitating wild animals

- Raising and Releasing animals

Be The Change Sunday Meal

West Warwick

Helping the homeless is always a priority, but they come more into focus with the arrival of the winter season. Help out the homeless this holiday season by making a donation HERE.

Be the Change Sunday Meal was named one of the great nonprofits of 2016 by greatnonprofits.org.

Be The Change Sunday Meal makes a difference by:

- serving Sunday meals

- collecting and distributing items of need (coats, socks, food) to the homeless

RI Dream Center

Cranston

Sometimes all it takes to turn someone's day or life around is giving them a little bit of hope. And a Rhode Island nonprofit is working to do just that. Make a donation HERE.

The RI Dream Center provides thousands of meals and thousands of punds of clothing to the homeless on the streets on a yearly basis.

The RI Dream Center makes a difference by:

- providing food, clothing and living supplies

- holding addiction meetings and giving referrals

Project Goal Inc.

Providence

Soccer is one of the few sports that are truly global. No matter where you are, nearly everyone knows how to play it.

Project Goal teams with the New England Revolution to help Rhode Island's disadvantaged youth by using the game of soccer. Make a donation HERE.

Project Goal currently operates after-school programs for sixth, seventh and eighth grade children from Providence, Pawtucket, and Central Falls every Monday and Friday.

Project Goal Inc. makes a difference by:

- combining the benefits of academic achievement with the motivation and self-discipline of sports

- promoting educational opportunity

- combating growing problems of illiteracy, school delinquency, adolescent crime and obesity

Newport Public Education Foundation

Newport

School is supposed to be fun, at least a little bit, and the Newport Public Education Foundation works to take care of that. Help make school fun by donating HERE.

How important are they? The Foundation provides funds and support for music programs, field trips and more by annually awarding $20,000 in grants.

Newport Public Education Foundation makes a difference by:

- supporting programs and services that address district-wide educational needs and enhance student learning

- fostering community volunteerism in the schools

- encouraging a community dialogue addressing school district-wide educational issues

- raising funds to support our current programs and to establish a strong financial foundation that will permit future expansion

- ensuring broad community participation in the organization and to create an organizational structure optimizing execution of all goals.

Children’s Wishes of RI

Warwick

Everyone has a wish and for kids who are battling their own personal life challenges, those wishes can seem very distant at times. Help make kids wishes come true this holiday season by donating HERE.

Here is one of their granted wishes:

"Johnnel is a 4-year-old boy who is legally blind and wished for a bedroom/therapeutic room makeover. He lives in Central Falls with his mom, dad, and siblings. His bedroom was re-done so that exercise mats were installed on the floors and walls. A handrail was also installed on the wall to help Johnnel learn to walk, as well as a double “Dutch” door. All construction costs were donated by LOPCO Contracting of Providence."

Children's Wishes of RI makes a difference by:

- granting wishes to children with life-threatening illnesses between the ages of 2 1/2-18 years old

PHOTO: Children's Wishes of RI

The Wolf School

East Providence

Everyone has different ways of learning and some have their struggles for any number of reasons. Supporting the education of children in need is a great way to give. Make donation HERE.

The Wolf School enrolls up to 60 children in six classrooms with 6-8 students per class in Lower School and up to 10 students per class in Middle School.

The Wolf School makes a difference by:

- utilizing an intensive and integrated model which allows children to discover their strengths and talents by meeting their academic, social and emotional needs

- having an individualized academic programming following grade level expectations

- having language based learning environment with sensory processing supports and social thinking skills immersed into the academic curriculum

Hope Funds for Cancer Research

Newport

The more researchers, the better chance of finding a cure for all types of cancer. Who doesn't want that? Make a donation HERE.

To date, Hope Funds for Cancer Research has completed funding of 14 fellowships, resulting in ten of these programs being published in top-tier journals and eight of these Fellows having already received faculty appointments.

In addition to these 14 completed fellowships, Hope Funds is currently funding 15 fellowships, with four of these having already been published.

The Hope Funds for Cancer Research makes a difference by:

- holding special events to help raise money for young researchers looking for fellowship opportunities

- honoring Hope Funds honors with an annual medal -- individuals or organizations who have made a significant impact to patient care

Crossroads RI

Providence

If you are concerned about the state's homeless during the holiday season, Crossroads RI is the largest homeless service organization in Rhode Island. Make a donation HERE.

Most recently, Amazon founder Jeff Bezos and his wife MacKenzie donated $5 million to Crossroads Rhode Island to help fight homelessness.

Donate goods like baby diapers, non-perishable food items, and toiletries to the organization this year to help those who are homeless or at risk during these winter months.

Crossroads RI makes a difference by:

- providing housing, basic needs, and shelter

- assisting with case management, referrals, education and employment services

Rock Paper Scissors

Wakefield

Living in the United States, students and families often have access to music and art programs at schools and in the community. Those in other countries, like Vietnam, might not be as fortunate -- and there are organizations working to help them. Make a donation HERE.

Rock Paper Scissors Children's Fund supports music and art programs for children in Vietnam.

Or you can even donate a bike to children who often have to walk long distances to get to school.

Rock Paper Scissors makes a difference by:

- providing learning opportunities for young students through art and music programs

Johnnycake Center

Westerly

A lot of people need help making ends meet, but not everyone qualifies for established agencies. That is where the Johnnycake Center comes in.

Help them end hunger by donating HERE.

The Johnnycake Center makes a difference by providing:

- emergency food pantry and emergency household items

- SNAP application assistance

- client service referrals

- school vacation breakfast and lunch programs, back to school supplies

- holiday meal programs

- senior food basket delivery

- pet food pantry

FabNewport

Newport

Sometimes it takes time to discover a passion, sometimes you just have to play around a bit, try different things. That is what FabNewport is all about. Help kids find their passions by donating HERE.

How important are they? FabNewport currently works with the East Bay Met School, the Newport Public Library, the Jamestown Arts Center, All Saints Academy, the Newport County Boys and Girls Clubs, the Jamestown Schools and area Home Schoolers.

FabNewport makes a difference by:

- encouraging students to discover their passions through play. Play means having time to fiddle, tinker and experiment with materials in encouraging environment supported by a coach

Best Buddies Rhode Island

Pawtucket

Best Buddies is dedicated to establishing a global volunteer movement that creates opportunities for one-to-one friendships, integrated employment and leadership development for people with intellectual and developmental disabilities. Make a donation HERE.

How important are they? Best Buddies has grown from one original chapter to almost 1,500 middle school, high school, and college chapters worldwide. Best Buddies programs engage participants in each of the 50 United States, and in 50 countries around the world.

Best Buddies makes a difference by:

- establishing a volunteer movement that creates opportunities for one-to-one friendships, integrated employment and leadership development for people with intellectual and developmental disabilities

RI Blood Center

Providence

Let's face it, everyone needs blood to live. Make a donation HERE.

The Blood Center is the only source of blood and blood products for the hospitals of Rhode Island while also serving Massachusetts and Connecticut.

Rhode Island Blood Center was established in 1979 as a non-profit community blood center.

The RI Blood Center makes a difference by:

- providing safe, plentiful & cost-effective blood supply

MAE Organization for the Homeless

West Warwick

MAE Organization is one of a number of groups working to alleviate homelessness in Rhode Island. Donate to MAE by clicking HERE.

How important are they? MAE currently provides hot meals, toiletries, shoes, bikes, tents to over 300 homeless and at risk individuals on the streets of Providence.

MAE makes a difference by providing:

- wellness programs, case management, job skills training

- counseling, treatment groups, and cognitive therapy

- facilitating drug and alcohol treatment

- mentoring programs and street outreach

Photo: MAE Organization for the Homeless

Operation Stand Down RI

Johnston

Those who served and are serving our country more than deserve to live good lives when they return to the states. Help Operation Stand Down provide that by donating HERE.

You can also help by organizing food drives for their other locations.

Operation Stand Down supports veteran soldiers who have experienced hardship and homelessness in Rhode Island.

Operation Stand Down RI makes a difference by:

- helping struggling and homeless veterans by offering services and housing necessary to their well being

Rhode Island Food Bank

Providence

Give the gift of food during the holiday season by donating to the Rhode Island food bank. Click HERE to donate.

How important are they? Millions of pounds of donated food and nonfood household products are distributed into the community through their network of 250 member agency food programs in the state.

The RI Food Bank makes a difference by:

- providing multiple programs to ensure that Rhode Islanders have access to the nutritious food they need

- utilizing Pantry Express and Direct Delivery programs to efficiently distribute healthy foods to high-need communities

SEE the Food Bank's Andrew Schiff on LIVE below:

Dr. Martin Luther King Jr. Community Center

Newport

From three-year-olds to adults, the MLK Community Center provides their clients with the tools and the knowledge that they need in order to reach their dreams. Help dreams come true by donating HERE.

The MLK Community Center is as impactful and meaningful to the 3-year -old toddler entering his first day of preschool as it is to breakfast program clients who come daily for a nutritious meal shared with friends.

The Dr. Martin Luther King Jr. Community Center makes a difference by:

- providing clients with the tools and the knowledge to reach their dreams

West Place Animal Sanctuary

Tiverton

Seeing hurt or sick animals doesn't have to leave you feeling helpless -- assisting with their care and recovery is one of the many ways you can give this holiday season.

You can do just that by donating to the West Place Animal Sanctuary HERE.

In 2017, West Place Animal Sanctuary was named a top-rated 5-star Nonprofit.

The West Place Animal Sanctuary makes a difference by:

- providing housing, food, and medical care for injured and orphaned wild birds, waterfowl and wild turkeys as well as unwanted farm animals

- overseeing rehabilitation services leading to the release of the aforementioned types of injured or orphaned wildlife, and providing placement services for farm animals whenever possible

Newport Festivals Foundation

Newport

The Newport Jazz and Folk Festivals draw thousands of fans to Newport every summer to enjoy great music by some of the best musicians who have ever lived. Donate HERE to help continue this great tradition.

The Newport Festivals Foundation is in charge of festivals such as the Newport Jazz Festival and Newport Folk Festival.

The Newport Festivals Foundation makes a difference by:

- preserving the legacy of the Newport Folk & Jazz Festivals

- nurturing the creation and education of folk & jazz music in Rhode Island, as well as internationally

St. Mary's Home for Children

North Providence

Children who experience violence in their homes can often be affected for the rest of their lives, and may never truly get over it.

The St. Mary's Home for Children provides services to help kids who are traumatized by violence in their homes. Click HERE to donate.

St. Mary's Home for Children makes a difference by providing:

- residential and outpatient services

- in-home services and educational services

Community MusicWorks

Providence

Music can serve as an important role in communities across the state and Rhode Island.

Community MusicWorks looks to create an urban community through music education and performance that can transform the lives of children, families, and musicians. Click HERE to donate.

Community MusicWorks makes a difference by:

- teaching, mentoring, program design, and performance activities of the Providence String Quartet

- creating an opportunity for a professional string quartet to build and transform its own urban community

WellOne Primary Medical and Dental Care

North Kingstown, Pascoag, Foster

You can never have a shortage of community health care facilities and organizations.

WellOne Primary Medical and Dental Care has been around for 108 years. Click HERE to donate.

WellOne Primary Medical and Dental Care makes a difference by:

- Provides high quality health Care to individuals and families.

- Promoting the highest quality of health for the individual and family as well as for the community.

Youth Pride Inc.

Providence

Building a community where lesbian, gay, bisexual, trans, and queer youth can develop and be themselves is a vital part of the world today. Donate HERE to help Youth Pride continue to provide that.

Youth Pride Inc. makes a difference by:

- providing free programs including individual counseling, weekly discussion groups, leadership trainings, social events and wellness activities.

- being an affirming space for lesbian, gay, bisexual, trans, queer, questioning young people to build community, develop connections and be themselves

Day One

Providence

Day One works to reduce sexual abuse and violence in Rhode Island, not only for survivors, but addressing the issue as a community concern

Click HERE to donate.

Day One makes a difference in the community by providing:

- 24-hour Helpline and legal advocacy

- law enforcement advocacy programs

- individual and group counseling

- professional training session and prevention education workshops

Amos House

Providence

Amos House provides direct support for people in need by offering meals, shelter, and other resources that help them achieve stability and services they need.

Donate to the Amos House HERE.

The Amos House started as a small soup kitchen, and today consists of a campus of 14 buildings including a restaurant, permanent supportive housing and a mother-child reunification center.

Amos House makes a difference in the community by providing:

- 90-Day recovery-based programs

- ten buildings dedicated to supportive housing as well as a mother-child reunification program

- culinary and carpentry training programs, and a literacy center and social enterprise businesses that employ men and women and generate income

Looking Upwards

Middletown

Founded in 1978, Looking Upwards is a private, nonprofit agency offering a wide array of services to adults with developmental disabilities and children with special healthcare needs.

Donate to them HERE.

How important are they? Looking Upwards serves more than 900 kids and adults across the state.

Looking Upwards makes a difference by providing:

services for adults with developmental disabilities

services for families of children with special healthcare needs

Little Flower Home

Providence

Providing a safe place for pregnant women and or young kids can be a monumental task. However, that is just what he people at the Little Flower Home are working to do, for Rhode Islanders in need.

Help them continue to make a difference by donating HERE.

The Little Flower Home makes a difference by:

- providing comfortable private room(s) in shared apartments or shared homes for pregnant women and their children at no cost for women dealing with domestic violence, or under undue pressure

- providing clean clothing for both mom and children as well as guidance with respect to the wide array of Social Services that are available

- assisting with food stamps and medical insurance for families and children

Lucy's Hearth

MIddletown

Lucy's Hearth is a 24-hour emergency and transitional shelter for mothers and their children who are homeless due to economic hardship, family crisis, divorce or any number of reasons.

Donate HERE.

In one year, Lucy's Hearth sheltered 52 families – 45 mothers and 80 children through their emergency shelter, transitional apartment, and permanent apartment programs, for a total of nearly 14,000 shelter and transitional bed nights, with more than 28,000 meals served.

Lucy's Hearth makes a difference by providing:

- an emergency shelter program as well as transitional and permanent apartment programs

- outreach and aftercare programs

Providence Animal Rescue

Providence

Homeless or lost animals often rely on the kindness of volunteers, and in this case a dedicated staff working to help them. Donate to Providence Animal Rescue HERE to help save these animals.

Providence Animal Rescue makes a difference by:

- providing appropriate shelter and humane care for homeless animals and seeking permanent responsible homes for adoptable animals

- reducing pet overpopulation through strict spay/neuter measures and providing a diversity of humane education programs to meet community needs.

Mentor Rhode Island

Warwick

An hour a week is all it takes for a mentor to make a difference in the life of a child.

Mentor Rhode Island works with 50+ programs statewide with over 5,000 children with mentors.

Mentor Rhode Island makes a difference because kids with mentors are…

- 46% less likely to begin using drugs

- 27% less likely to begin using alcohol

- 53% less likely to skip school

- 33% less likely to engage in violence

Rhode Island Interscholastic League

Providence

Sports can helps kids get through their day, week, month and maybe longer. The Interscholastic League helps make that possible -- donate HERE

How important are they? There are 60 public, private, and parochial high schools who make up the league. These schools sponsor athletic activities in 28 sports. More than 20,000 young men and women compete

The Rhode Island Interscholastic League makes a difference by:

- supervising and administering the athletic programs contests

- scheduling and overseeing matters related to the participating schools throughout the state

Dorcas International Institute of RI

Providence

Anyone who is trying to overcome cultural, educational, economic or language barriers in Rhode Island can go to Dorcas for help.

And you can help Dorcas by donating HERE.

Dorcas International Institute makes a difference by providing:

- education & workforce training

- a Center for Citizenship & Immigration Services

- full service community school, refugee resettlement, interpreting & translating

- a clothing collaborative and welcome center

The Burke Fund

Providence

The Burke Fund provides financial aid to students involved in the game of golf to help them get a college education. It is one of the oldest golf scholarship programs in the country.

Since its inception, the Burke Fund has awarded over $3 million in college financial aid.

The Burke Fundmakes a difference by:

- providing financial aid to students involved in the game of golf to help them get a college education.

Stages of Freedom

Providence

There is no better time to support the work of Stages of Freedom in enriching and empowering Rhode Island children of color.

Stages of Freedom makes a difference by offering programs such as:

- Bow Ties for Boys, which teaches grooming and social skills to Black boys

- Girls Tea Party, which teaches social graces and table manners to young girls of color at an elegant tea party

- Swim Empowerment, which teaches children of color how to swim to drive down the high rate of drownings in our community. Last year we taught 311 children to swim at area YMCAs by paying for their lessons through private donations. We also provide opportunities for them to engage with their culture and history through lectures, performances, exhibits and walking tours.

National Federation of the Blind of RI

East Providence

The membership-based consumer advocacy organization works to change what it means to be blind.

Help the blind -- and their families -- by donating HERE.

National Federation of the Blind makes a difference by:

- providing 2 chapters, with the Greater Providence Chapter meeting the third Saturday of the month in East Providence and the Mount Hope Chapter meeting the third Thursday of the month in Bristol

- working to improve the quality of education for blind children

- retaining the earning levels for blind people so that it is equal to people of age sixty-five

Operation Support Our Troops

N. Kingstown

Imagine being thousands and thousands of miles away from friends and family, and on top of that needing to be ready to go to war at any moment. Support the troops by donating HERE.

Operation Support Our Troops gives those fighting for our freedom a sense of home.

You can even make a donation in honor of a soldier in your life.

Operation Support Our Troops makes a difference by:

- sending care packages to troops

- providing personal messages of support, as well as other home items that are not readily available.

Providence Revolving Fund

Providence

Preserving the beauty of Providence's architectural heritage is important to the community and the entire state. You can donate to the Providence Revolving Fund HERE.

The Revolving Fund manages two capital funds, the Neighborhood Fund with over $1.9 million in assets and the Downcity Fund with $7.2 million.

The Providence Revolving Fund makes a difference in the community by:

- partnering with neighborhoods and community-based organizations

- retaining and developing affordable housing

- collaborating with others to preserve and develop real estate

- serving as a catalyst for public and private investment