URI Economist Lardaro's Index Shows RI's Economy Stabilizing

Len Lardaro, URI Economist

URI Economist Lardaro's Index Shows RI's Economy Stabilizing

In spite of the seemingly strong October performance, there were data anomalies (as far as I can tell) whose effects lingered. Recall that for September, our state’s Labor Force and Resident Employment both exploded on a monthly basis — the Labor Force by +43,300 and Resident Employment by +44,000. Historically changes of these magnitudes occur over the course of about three years! Over that same month, payroll employment, the number of RI jobs, rose by “only” 3,000. Well, what explodes eventually implodes, and that’s what we saw in October: Our Labor Force fell by 26,300 while Resident Employment dropped 25,700 and payroll employment fell by 2,100. For those interested, I posted a number of tweets about this on 12/9 that highlight how bizarre this is. I expect upcoming data revisions to clear this up, so take these data with a serious grain of salt. Between this and the amazing declines in new claims.

Related to the filtering out of fraudulent claims, it should be easy to see how difficult it is to navigate through the existing data.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

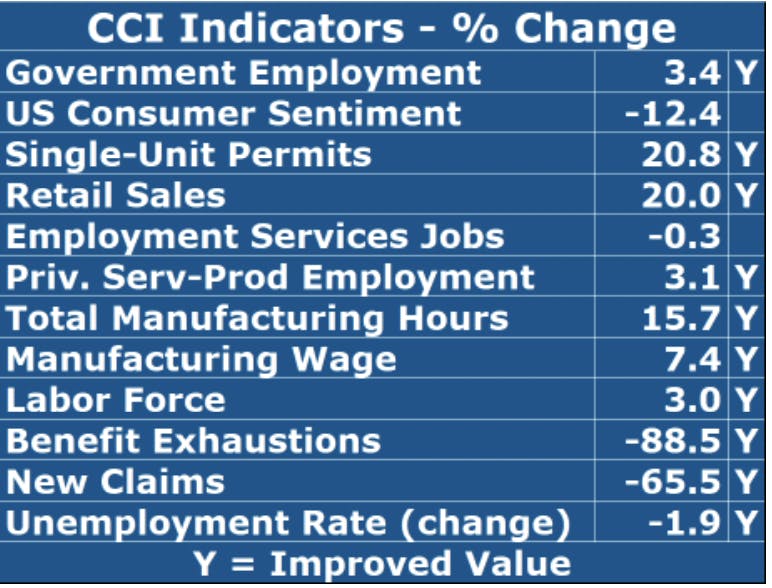

For October, the Current Conditions Index remained at 83 as ten of the twelve CCI indicators improved, many the result of easy

“comps.” Retail Sales remained the star CCI performer, rising by 20 percent from a year ago, its ninth consecutive double-digit increase. Of the five leading indicators present in the CCI, once again only three improved in October and two of these tuned in noteworthy performances.

Rhode Island’s Labor Force imploded compared to last month but was 3 percent higher than last October. Our Unemployment Rate rose from 5.2 to 5.4 percent along with the one-month implosions for the Labor Force and Resident Employment.

The monthly CCI remained stuck at 58, in expansion range, after several months of weakness. It is still well below the regular CCI value. Behind this number was a string of declining indicators such as the Labor Force and Unemployment Rate, US Consumer Sentiment and Government Employment, a sign of possible slowing ahead.