Lardaro: “3 to 5 Years Before Rhode Island Returns to Its Pre-Pandemic” Economy

Leonard Lardaro, URI Economist

Lardaro: “3 to 5 Years Before Rhode Island Returns to Its Pre-Pandemic” Economy

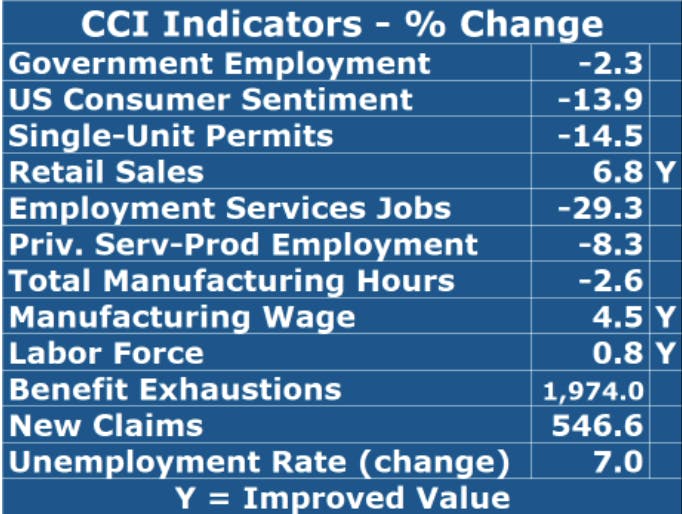

For September, the CCI once again remained below 50, stuck at its recent plateau of 25 for the fourth consecutive month. So, as both determinations show, Rhode Island is in a recession at the present time, and has been in a recession since March.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

What then, will constitute a recovery? How will we be able to identify it when it occurs? A recovery is not a return to the levels of activity that existed prior to the recession. In other words, it is not necessarily a return to “normal” times. Instead, it is a sustained period of increasing overall economic activity.

In light of this, I strongly believe that it will take 3—5 years before Rhode Island returns to its pre-pandemic levels of activity (which wasn’t exactly much to brag about). Therefore, expect a painfully slow recovery when it does occur, one where most people will probably remain unconvinced that a recovery is actually occurring. Measuring the likelihood of our being in a recovery will be most effectively be gauged by following month-to-month changes in my CCI.

For September, while the CCI based on yearly changes remains convincingly in contraction territory (at 25), the monthly CCI (below) has for the first time since the pandemic began moved into expansion territory, at 67. If we can sustain above-50 values, we will be moving towards or in a recovery. Unlike cyclical recessions, though, we won’t need to rely primarily on improving financial conditions.

This time, everything hinges on COVID containment, an effective vaccine, fiscal and monetary policy, all of which are beyond Rhode Island’s direct control. My worry is that two key non-survey based CCI indicators are moving in the wrong direction: Both Benefit Exhaustions, which reflects long-term unemployment and New Claims, the best measure of layoffs, have begun to oncer again move higher.