Top URI Economist: RI's Economy Is Slowing

Leonard Lardaro, URI Economist

Top URI Economist: RI's Economy Is Slowing

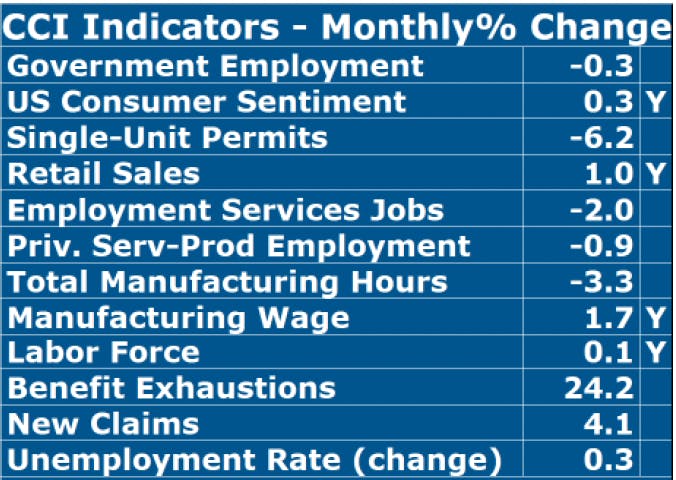

So, with the national economy slowing and after such strong economic momentum here, it was to be expected that the pace of activity would slow, resulting in a CCI of 75 in October. Still, nine of the twelve indicators improved relative to a year ago, with several bettering difficult “comps” from last October. Remember the prime economic directive: Don’t make too much from a single month’s value. After all, October was the sixteenth consecutive month with Rhode Island’s economy expanding (CCI above 50).

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLAST

Clearly, its values have been slipping since April, leading to the expectation that deteriorating monthly performance would eventually translate into the annual changes. This call was made more difficult by the fact that October employment numbers are often changed with rebenchmarking, which may well be the case this year. So, any speculation that what we are witnessing is the first stage of LO (Last Out) is clearly premature. Ironically, large amounts of unspent federal funds received by Rhode Island, when spent in the coming months, will give us a boost through much of 2023, potentially dethroning us from the LO designation!

Do these instances of slowing of growth presage actual declines in the coming months? Quite possibly they might. As has been the case for some time, two labor supply measures improved dramatically in October. Benefit Exhaustions, a reflection of long-term unemployment, fell by 48.7 percent, continuing a trend that began in May of 2021. New Claims, a leading labor indicator that reflects layoffs, declined by “only” 38.4 percent relative to a year ago. It too has fallen at double-digit rates since July of 2021.

As noted above, the troubling news this month was that for Employment Service Jobs, a leading labor market indicator that includes temps. It fell by 6.3 percent, erasing several months of improvements. While payroll employment has been improving on a yearly basis for some time now, it has declined on a monthly basis for the past two months, which could be a problem since it remains well below its pre-pandemic levels. Resident employment, on the other hand (the number of employed RI residents in state or out-of-state), has been flat for the past four months, while the employment rate declined in October.

Of the two indicators that had performed badly of late, US Consumer Sentiment fell once again, by 16.6 percent, failing to improve for fifteen consecutive months, while Single-Unit Permits, which reflect new home construction, declined at a double-digit rate (-12.4%), sustaining its downtrend.

The Labor Force has been rising on an annual rate of late, coinciding with rising Unemployment Rates. The participation adjusted rate for October rose to 4.5 percent.